Expect crude inventory builds with maintenance season approaching; wide spreads to support exports

Three Things

Another monster builds, coupled with another large adjustment number.

Exports are high and stable, supported by wide spreads from the USGC.

Distillates inventories slowly normalizing, though maintenance may slow the pace.

Crude Oil

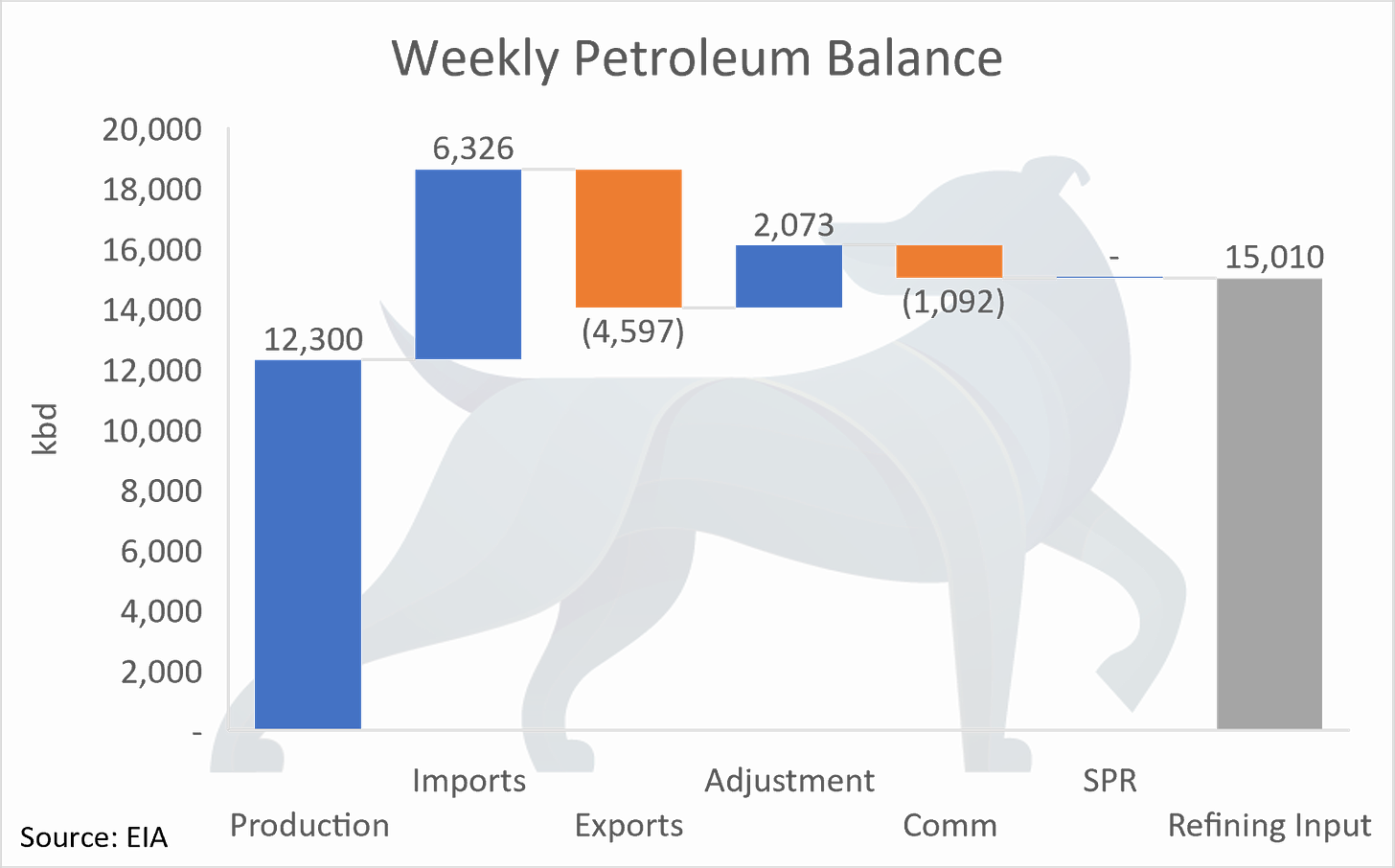

The EIA reported another monster build in last week’s weekly petroleum status estimate. This time they estimated US commercial crude stockpiles swelled by 7.65mm bbls, again followed by a huge adjustment number (2.1mm bpd). The build (and adjustment) came despite the EIA lifting its estimated exports to ~4.6mm bpd.

Vortexa’s shipping and satellite coverage also shows strong exports, with each of the last four doe reporting weeks recording more departures than the previous. Over the last month, Vortexa estimates US crude/condensates exports averaged ~4mm bpd, reaching 4.25mm bpd during the last EIA reporting week, the week ending 17 Feb 2023. Early data for the upcoming week suggests this trend will continue, with another >4mm bpd loading pace through Friday.

Asian and European destinations make up nearly 90% of US exports over the last month, at 1.28mm and 1.37mm bpd, respectively. With the Brent/WTI spread trading at -$6.84/bbl prompt and -$6.35/bbl for next month, there should be sufficient incentive to maintain these flows into Europe. Likewise, WTI trades at ~$6.75 discount to Murban crude, pointing to continued flows to Asia, especially if refinery capacity utilization remains low/falls lower during maintenance season. To that end, it sounds like it could be an active maintenance season, which could lead to more inventory builds and some seasonal softness in oil prices.

Refined Products

Getting less attention, but generally in line with what we’ve written, distillates inventories in the US are normalizing, as well. In fact, with last week’s estimated 2.7mm bbl build, the pace of normalization accelerated. As a result, distillates stocks have risen at an average pace of 1.67mm per week over the last month, the fastest 4-week average since Christmas.

Globally, product stocks were roughly flat and, like US distillates, appear to be normalizing relative to long-term trends. China watchers were scrubbing data that included mobility, airline traffic, and even air quality. Notably, Chinese gasoline exports dipped, continuing to back off the peak in December, when gasoline exports reached ~2mm bpd. During January, those dropped to ~1.1mm bpd and have paced 1.3mm bpd during February.